Cost Recovery Gst . learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for.

from blog.saginfotech.com

learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for.

GOI May Plan to Increase 1 on Current 5 GST Rate SAG Infotech

Cost Recovery Gst detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can.

From www.gstsuvidhakendra.org

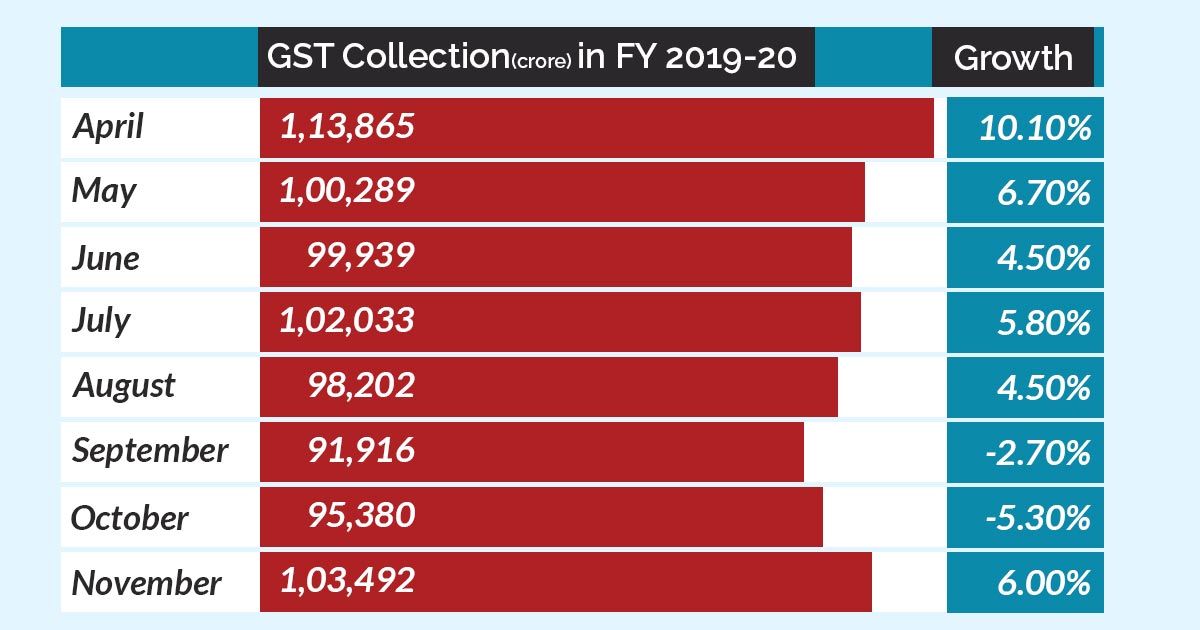

In the 5 consecutive months, GST recovery reach above 1 lakh crore Cost Recovery Gst leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. Hi, in ordinary course of our. Cost Recovery Gst.

From shopscan.in

GST Scrutiny Assessment Adjudication Demand & Recovery Cost Recovery Gst learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. learn how to deal. Cost Recovery Gst.

From www.professionalutilities.com

Recovery of GST Interest on Net Cash Liability declared through Cost Recovery Gst learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. Hi, in ordinary. Cost Recovery Gst.

From www.linkedin.com

GST Liability on Notice Pay Recovery from Employees Cost Recovery Gst detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. Hi, in ordinary course of our business, we incur. Cost Recovery Gst.

From www.akounto.com

Cost Recovery Method Definition & Examples Akounto Cost Recovery Gst cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. detailed. Cost Recovery Gst.

From www.youtube.com

Demands and Recovery in GST YouTube Cost Recovery Gst learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. cost recovery policy—the policy of. Cost Recovery Gst.

From www.finance.gov.au

Australian Government Cost Recovery Guidelines (RMG 304) Department Cost Recovery Gst leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. Hi, in ordinary course of our business, we incur. Cost Recovery Gst.

From www.slideshare.net

Demands and Recovery under GST Cost Recovery Gst leveraging deloitte’s proprietary revatic smart technology and our global network of indirect tax professionals, businesses can. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. learn. Cost Recovery Gst.

From www.awesomefintech.com

Modified Accelerated Cost Recovery System (MACRS) AwesomeFinTech Blog Cost Recovery Gst learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how. Cost Recovery Gst.

From blog.saginfotech.com

GOI May Plan to Increase 1 on Current 5 GST Rate SAG Infotech Cost Recovery Gst Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. leveraging. Cost Recovery Gst.

From www.gstsuvidhakendra.org

Signs of recovery on the economic front, exports accelerate after GST Cost Recovery Gst detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. learn how to apply gst when you recover. Cost Recovery Gst.

From gstpanacea.com

GST Procedure Related to Demands and Recovery GST Panacea Cost Recovery Gst learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. learn how to differentiate. Cost Recovery Gst.

From www.superfastcpa.com

What is the Cost Recovery Method? Cost Recovery Gst learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government.. Cost Recovery Gst.

From www.taxscan.in

GST recovery in Absence of GSTAT Orissa HC Directs to pay 20 of Cost Recovery Gst learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. learn. Cost Recovery Gst.

From www.taxscan.in

Recovery of GST during IBC Proceedings CBIC Clarifies Cost Recovery Gst cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to differentiate reimbursement and disbursement for gst purposes and avoid gst errors when recovering. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers.. Cost Recovery Gst.

From www.health.gov.au

Cost Recovery Implementation Statement Administration of the Cost Recovery Gst learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client. Cost Recovery Gst.

From www.accoxi.com

What is GST Demand & Recovery Accoxi Cost Recovery Gst cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn how to apply gst when you recover expenses from another party, such as your employees, customers, or suppliers. learn how to deal with expense reimbursements from a gst/hst perspective, depending on who is the.. Cost Recovery Gst.

From cleartax.in

GST Procedure for Audit, Assessment, Ruling & Recovery Cost Recovery Gst detailed information about how federal goods and services tax (gst) and harmonized sales tax (hst) legislation. Hi, in ordinary course of our business, we incur telephone charges on monthly basis specifically for client for. cost recovery policy—the policy of the australian government to recover, where appropriate, some or all of the efficient costs of specific government. learn. Cost Recovery Gst.